Trade Credit Insurance

Why Socovered?

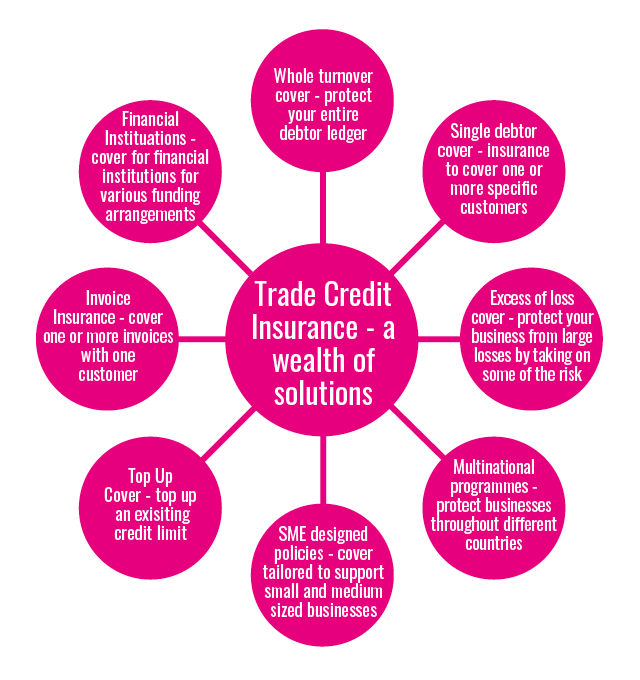

In a nutshell, Trade Credit Insurance is not just policy, it’s a service that monitors creditors and protects businesses. We can help take away the stress that late payment brings, protecting what you have and enabling you to concentrate on what you do best – growing your business.

- We pride ourselves in getting to know our customers’ business and understanding their individual needs

- We will use our specialist knowledge of the credit insurance market in order to tailor a credit insurance package that will cater for your requirements.

- We will provide assistance should any of your customers need a higher credit limit facility

- Should insurer(s) flag up a potential problem with the credit worthiness of any customer(s) going forward, we use our expertise to make sure you get fast, accurate and reliable information to enable you to take the appropriate action.

- In the event of a claim, we will manage the process efficiently to ensure fast payment in order to protect your cash flow

- We always endeavour to manage your credit insurance policy professionally, from inception to renewal, in order to be certain that you are receiving the very best level cover at the most cost-effective price.